In this lesson we are going over the very basics of how profits can be made through Forex trading.

The interesting thing about currency trading is that you can make profits even when exchange rate of a pair begins to drop, given that you choose the right position to take.

Let’s get into it.

The Main Idea

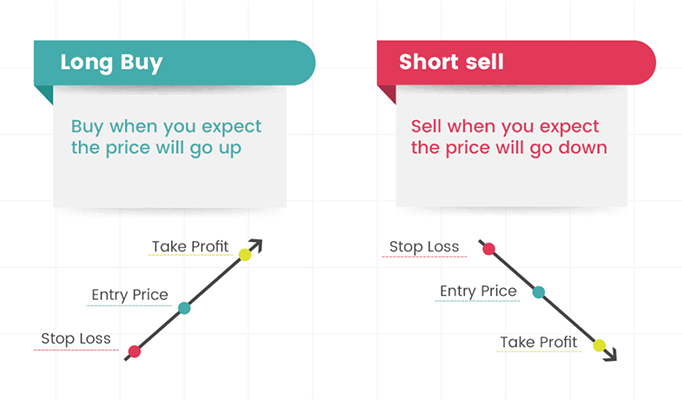

There are two types of trades that can be carried out in Forex.

A trader can buy or sell.

Buying

The goal is to buy currency when you feel its value is about to take a hike. When that hike comes and the value increases, sell it at a profit.

Selling

The goal is to sell currency when you feel its value is about to depreciate. When the value has dropped, buy it back and you will have to pay less than what you got for it when it was initially sold.

Putting theory into action

The transaction always takes place using two currencies. The currency pair we will be trading in this example is AAA/BBB. The fact that this currency pair does not exist cannot stop us.

So you think the value of A is about to increase in the coming days/weeks. You see the quote “AAA/BBB 1.5”. This means that for 1.5 BBBs you can buy 1 AAA and decide to enter this trade. You buy a Standard Lot (A Standard Lot means 100,000 units).

To buy a Standard Lot of AAA you pay 150,000 BBB (1.5x100,000). This means that 150,000 BBB have been used to buy 100,000 AAA. When you’re trading on margin, you don’t need to have 150,000 BBBs in order to make this trade, but for the sake of clarity we are not going into that in this example.

A week passes and there has been a major hike in the value of AAA, just as you expected. The quote now says “AAA/BBB 1.6”. So you sell i.e. you sell the 100,000 AAA you bought for BBB.

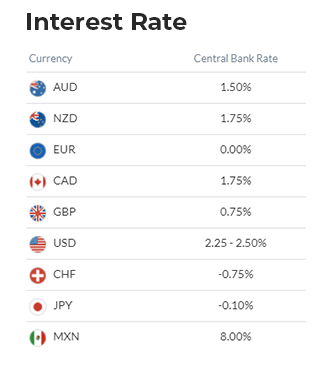

Rollover

Even though the FX market itself is a 24 hour business, the particular broker you’ll be working with will close at 5 pm according to their time zone.

Exotic Pairs:

When a major currency is paired with a currency from a developing economy such as Brazil, South Africa, or Mexico, they form Exotic Pairs. Examples of exotic pairs include:

Signup for an account in just 1 minutes. PayPal or major credit card.

Daily alerts to your phone, email or website account. Buy, sell and stop-loss points that are easy to follow

See how your investments grows